Why we have been monitoring oil price very carefully

A Glimpse into our macro picture for the second half 2025

What has raised our eyebrows over the last 3 months

Reflexivity, a concept introduced by George Soros, describes the self-reinforcing feedback loops in financial markets that can drive prices far from intrinsic value, particularly during regime changes. Market participants’ biases can influence the fundamentals they interpret, leading to non-linear market dynamics. However, predicting when these feedback loops will break remains challenging, as the risk is often highest when sentiment is strongest.

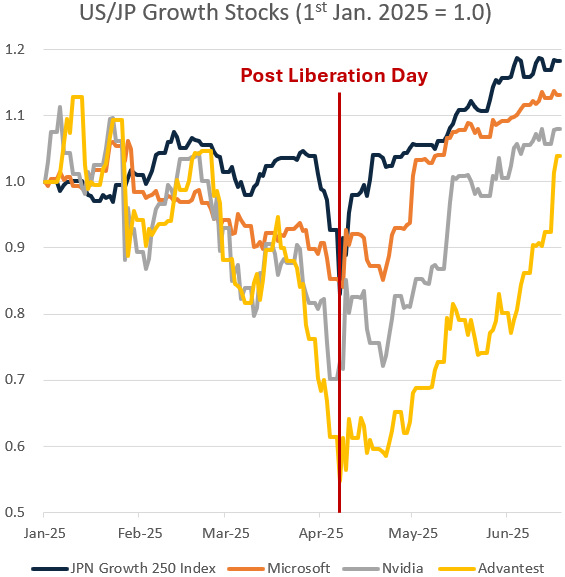

Growth stocks have recently provided a vivid example of Reflexivity theory. Their performance after Liberation Day has surely raised our eyebrows. It is true that there were several positive catalysts that fueled this rally. Notably, Microsoft’s announcement of increased AI capital expenditures on April 30 and Nvidia CEO Jensen Huang’s keynote address at the GTC Paris conference on May 11 have both contributed to renewed optimism in the growth sector. Despite these encouraging developments, it is striking how many investors appear to be overlooking the potential risks posed by a higher term premium.

This is particularly surprising given the negative impact that elevated term premium had on growth stocks during the first quarter of the year. The surge in term premium began as early as December 2024, driven by the bear steepening of the U.S. Treasury yield curve. Since a higher term premium translates to a higher discount rate, growth stocks are especially sensitive to these changes, which explains why an investor should be extra-cautious to own such equities. Nevertheless, growth stocks are now trading 5–20% above their levels at the start of the year.

As of 11th June, weaker-than-expected U.S. CPI data pushed up hopes for a Fed’s rate cut (although we think the probability is low). Typically, a Fed rate cut leads to a flattening of the yield curve, a pattern that growth equity investors have come to expect. This anticipation has been a recurring theme for market participants to price in lower discount rates ahead of policy moves. However, it’s important to note that this usual correlation broke down in September 2024. When the Fed cut its policy rate by 50bps, long-duration U.S. Treasuries were sold off rather than rallying. This shift highlights the need for investors to remain cautious and not rely solely on historical patterns when navigating the market.

This incident last September is a signal that we are undoubtedly under a regime change. It is no secret that the U.S. debt has reached an unsustainable level, now standing at $37 trillion. Given that the U.S. is the heart of global capital markets, all investors should be monitoring this with great caution. With legitimate concerns around the dollar, it is prudent to prepare for a potential scenario of a major sell-off in long-duration U.S. Treasury.

Following the U.S. tariff announcement on Liberation Day, we saw investors begin to price in some stagflationary sentiment. However, with underlying macroeconomic data holding up better than expected, the economy has not yet entered a stagflationary environment. Looking ahead, it will be critical to develop a robust framework for interpreting the macro picture in the second half of the year.

For this reason, we have been closely monitoring oil prices over the past few months. In our view, oil price movements are a key variable that will shape the macroeconomic landscape in the next coming months. Also, we took a tactical position in crude oil in April, after WTI crude oil fell below $60/bbl.

In this article, we will share our thought process behind tracking oil prices so closely, as well as provide a glimpse into how we are preparing for the second half of the year.

Keep reading with a 7-day free trial

Subscribe to Arata Capital Management to keep reading this post and get 7 days of free access to the full post archives.